RetireRich

Plan, Act, Relax!

We help hardworking individuals craft retirement plans tailored to their life goals. By seamlessly blending health, wealth, and community priorities, we prepare you for a secure and fulfilling future, both now and in the years to come.

About RetireRich.ai

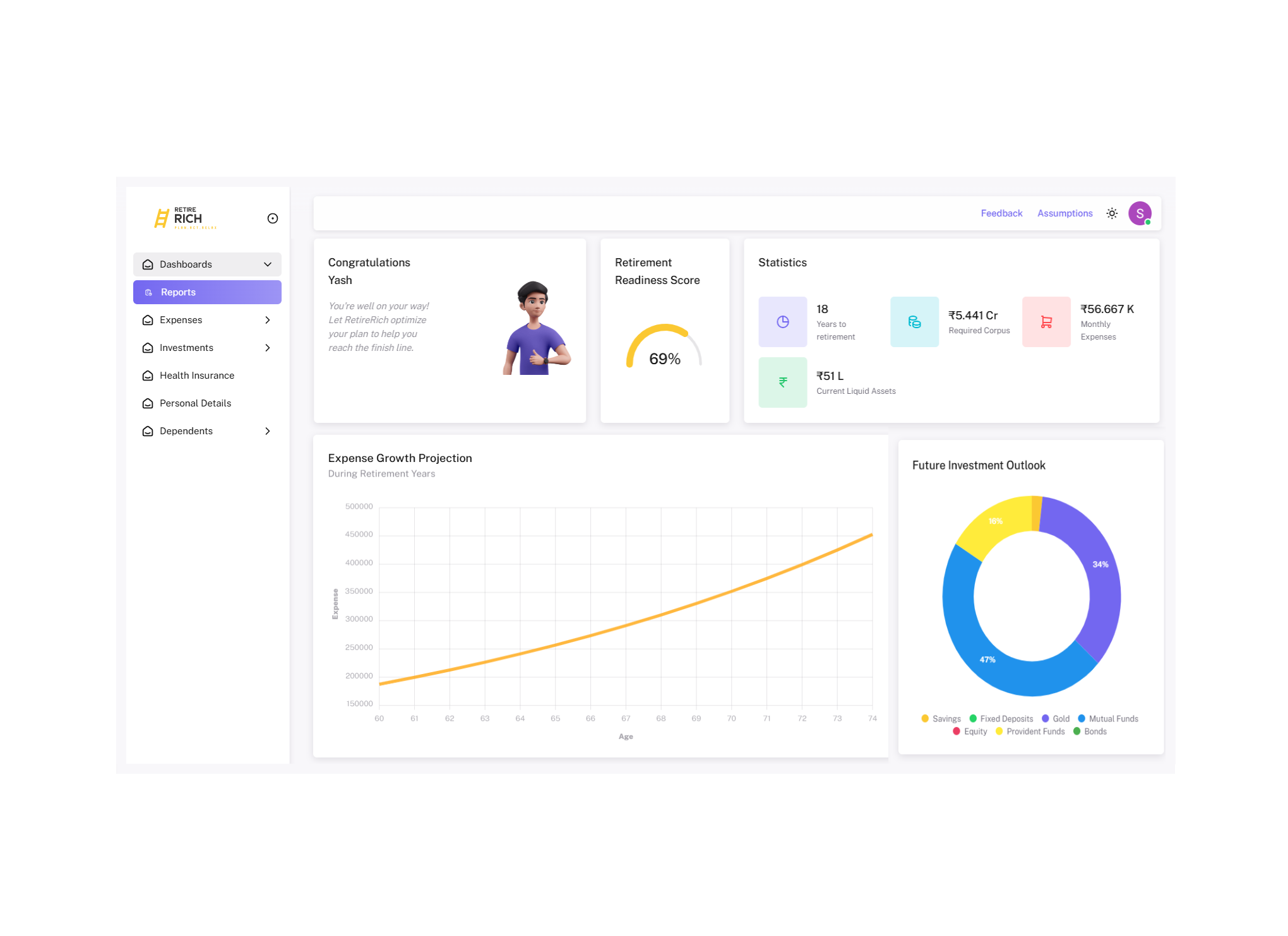

Meet India's first AI Powered Retirement Planning Website: your one-stop solution to gain insights, craft your plan, take action, and secure your future.

• Design your retirement plan, update it anytime, and explore different scenarios whenever life changes.

• No need for an advisor; you have the power and knowledge at your fingertips. It’s like having an expert in your pocket, only smarter, faster, and always ready when you are.

• Super easy to create, manage, and maintain—because your retirement should be as dynamic as you are!

Featured Videos

What is RetireRich.ai?

Click play to understand more about RetireRich.ai

How to Use RetireRich.ai?

Click play to learn how to use RetireRich.ai to generate your Retirement Readiness Score.

News & Events

Stay up-to-date with the latest happenings and upcoming events

Bangalore Tech Summit - 2024

RetireRich Makes a Stellar Debut at the Bangalore Tech Summit 2024

The Bangalore tech summit, renowned as a melting pot of innovation and technology, provided the perfect platform to unveil our product to a diverse audience. The timing couldn’t have been better, as it gave us an invaluable opportunity to validate our idea in real-time, interact with potential users, and gain insights into their financial planning needs.

Key Highlights from the Event

- Massive Interest Across All Age Groups: Our booth attracted visitors from all walks of life—students curious about starting early, professionals seeking smart financial strategies, and retirees eager to secure their future. The enthusiasm from all age groups reaffirmed the versatility and relevance of RetireRich.

- Valuable User Feedback: Engaging directly with users allowed us to gather constructive feedback on our platform. These insights are already being analyzed and integrated to further enhance the user experience.

- Overwhelming Response with 250+ Spot Registrations: We are excited to report that over 250 individuals signed up for RetireRich during the summit. This overwhelming response is a testament to the growing awareness about the importance of retirement planning and the trust placed in our solution.

- Product Appreciation: The simplicity, personalization, and efficiency of our platform were highly appreciated. Visitors were particularly impressed with features like the Retirement Readiness Score and tools for calculating net worth and planning future goals.

A Memorable Milestone

- Participating in the Bangalore Tech Summit was a significant milestone for RetireRich. The vibrant tech ecosystem, combined with the curiosity and engagement of the attendees, created the perfect environment for launching a product aimed at simplifying financial planning. This experience has not only validated our vision but has also inspired us to work harder to deliver a platform that truly empowers users to achieve their financial goals.

Thank You for Your Support!

- We extend our heartfelt gratitude to everyone who visited our booth, shared their thoughts, and encouraged us on this journey. RetireRich is built for you, and your feedback fuels our mission to make retirement planning accessible, easy, and impactful. Stay tuned for exciting updates as we continue to evolve and expand our offerings. If you missed us at the summit, don’t worry—visit RetireRich to explore how we can help you plan your financial future.

Retirerich on Radio Mirchi 98.3 FM

We’re Making Waves on National Startup Day!

We are thrilled to share some exciting news! Our startup, RetireRich.ai was honored to be selected as part of the National Startup Day Program by Radio Mirchi 98.3 FM on 16th Jan 2025, a prestigious platform that celebrates innovation and entrepreneurship across the nation.

As part of this incredible recognition, we had the privilege of being interviewed live on air, where we shared our journey, vision, and the groundbreaking work we’re doing to transform Retirement Planning.

🎙 What We Shared on the show:

- The inspiration behind starting RetireRich.ai.

- How is our platform RetireRich.ai is making a difference.

- The challenges we’ve faced as a startup and how we’ve overcome them.

- Our plans for the future and how we aim to impact the community.

🌟 A Milestone for Us:

📢 Stay Tuned:

- This is just the beginning! We are excited about the road ahead and can’t wait to share more milestones with you. Follow us to stay updated on our journey!

Beyond Savings and Investments

Savings matter, but income, dependents, goals, and spending habits also shape your retirement plan

Real Estate

Track and manage your current and future real estate.

Income

Income from salary, rental, business, and any other parallel income.

Loan

Home loans, Car loans, personal loans, and any other type of loans.

Dependents

Track your dependent needs.

Goals

Yours or your families life goals such as Europe trip, buying your dream car, kids masters, sisters wedding, and much more.

Expenses

Monthly expense, EMI, Insurance premium, Credit card payments, and much more.

Medical

Monthly medical expenses, health insurance for self/family/dependents, and any other risks.

More Options

...and dozens of other factors.

Frequently Asked Questions

Browse through these FAQs to find answers to commonly asked questions.

How secure is the Platform?

Our platform is built with robust security, with end-to-end encryption for data transfer, it is hosted on the reliable and trusted Microsoft Azure cloud platform, secured by SSL certificates and the latest TLS protocols (1.2 and 1.3), we have further enhanced by encrypting all stored data.

How does this platform determine my retirement corpus?

The platform evaluates multiple factors, including your current age, planned retirement age, expected lifespan, monthly expenses for yourself and any dependents, long-term financial goals, medical insurance coverage, inflation rate, and projected investment returns. By analyzing these elements, it calculates the total amount you will need to ensure a comfortable retirement. Additionally, the platform incorporates any existing savings and investments you have into its estimation to provide a comprehensive retirement corpus calculation.

What is the ideal retirement age in India?

The ideal retirement age varies based on personal preferences, financial goals, and health. However, many Indians aim to retire around the age of 60, coinciding with the age of superannuation in most jobs. It’s important to plan early to meet your desired retirement age comfortably.

What is the inflation rate assumed in retirement planning?

The platform generally assumes an inflation rate of about 5-6% per annum, based on current and historical data. However, you have the flexibility to adjust this rate according to your expectations or prevailing economic trends. While our tool recommends the latest inflation trends, you can choose to use these suggestions or input your own value. This Inflation rate will change in future.

How often should I review my retirement plan?

It’s advisable to review your retirement plan monthly, quarterly once at least or whenever there is a significant change in your financial situation, such as a major expense, salary hike, a new family member, new goal to be achieved, or a change in lifestyle. Regular reviews help ensure that you stay on track with your retirement goals.

What investment options are recommended for retirement in India?

Our platform doesn’t endorse any specific financial product. Instead, it offers a smart approach by suggesting various investment methods that are currently performing well in India, like the Employee Provident Fund (EPF), Public Provident Fund (PPF), National Pension System (NPS), mutual funds, stocks, fixed deposits, gold and more. It’s important that you do your own research and make informed decisions based on your personal financial situation. This feature to be available for paid subscribers only (Monthly/Annually).

Ready to Get Started?

Start your Retirement Planning from today.

Guess What?

This tool was born from the founder's own quest to solve retirement planning dilemmas in their early 40's, tired of juggling with multiple spreadsheets, they came up with a smart intuitive solution for the modern generation.

Any question or remark? just write us a message

Send a message

If you want to know more about retirement planning, payments, accounts, collaboration & corporate white labeling, you're at the right place.